What the FARE Act Means for NYC Renters and Landlords: A Complete Guide

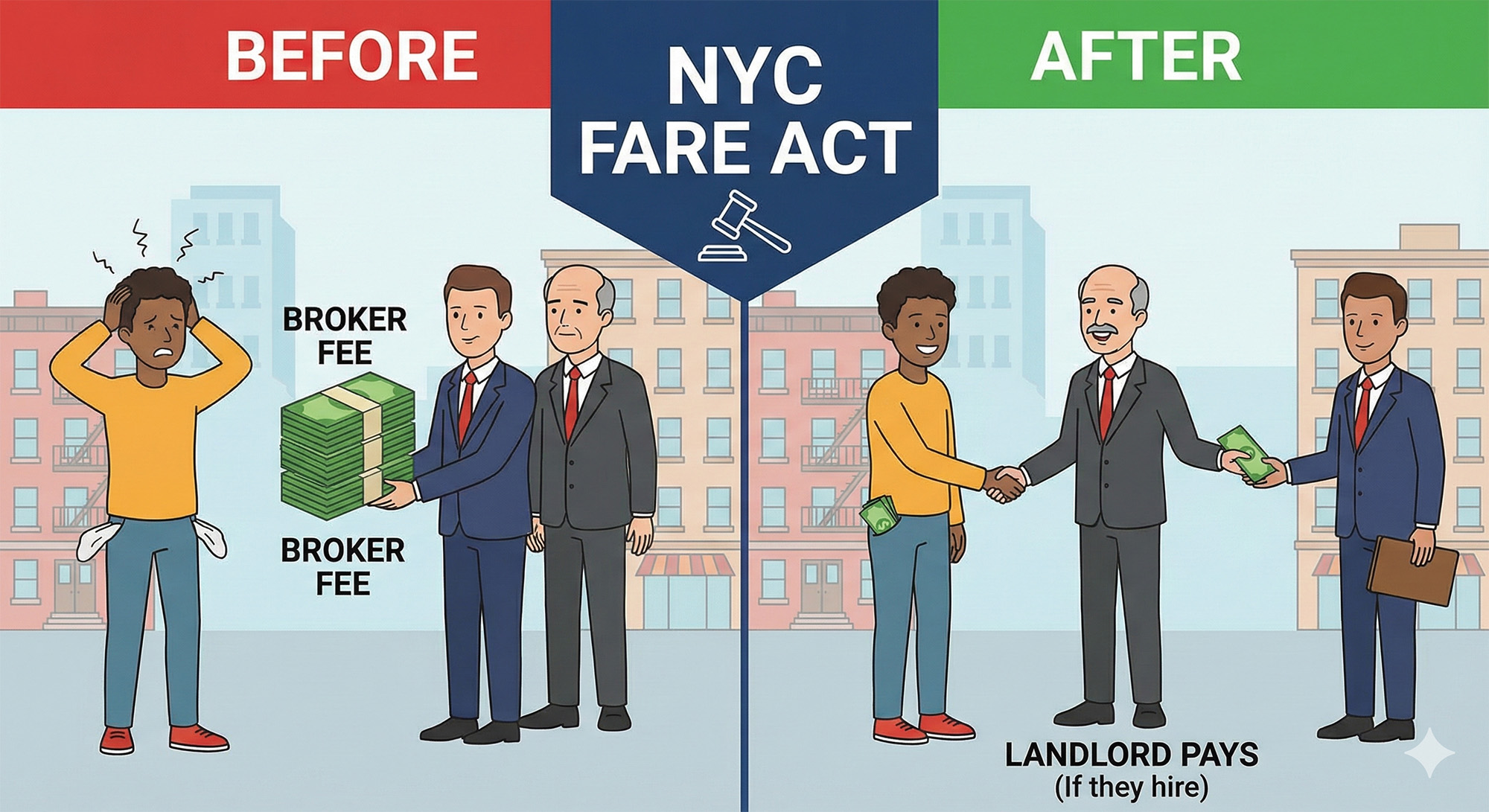

For decades, New York City has operated under a unique (and often frustrating) real estate anomaly: The tenant almost always pays the broker fee, even if that broker was hired by the landlord to represent the landlord’s best interests.

That dynamic is officially changing with the introduction of the FARE Act (Fairness in Apartment Rental Expenses Act).

This legislation fundamentally shifts the financial burden of renting in the five boroughs. Whether you are hunting for your next apartment or trying to fill a vacancy, here is what you need to know about the new law of the land.

The Core Rule: "He Who Hires, Pays"

The FARE Act introduces a simple logic that exists in almost every other industry but was absent in NYC real estate: ** The party that hires the real estate agent is responsible for paying their commission.**

Before the FARE Act: A landlord would hire a listing agent to market their apartment. That agent would screen tenants and show the unit. When a lease was signed, the tenant would be handed a bill for 15% of the annual rent (often $3,000–$6,000) as a "Broker Fee."

Under the FARE Act:

-

If a landlord hires an agent to list and market their apartment, the landlord pays the commission.

-

If a tenant hires an agent to search for apartments and represent them (a true "Tenant’s Agent"), the tenant pays the commission.

What This Means for Renters

1. Lower Upfront Costs The immediate impact is a massive reduction in the cash required to move. For a standard $3,000 apartment, the move-in cost used to include a ~$5,400 broker fee. That barrier is now removed for the vast majority of listings.

2. True Representation In the past, tenants paid for agents who were legally obligated to get the highest rent possible for the landlord. Now, if you choose to pay a broker, you are paying them to work for you—negotiating the rent down and finding off-market deals.

3. Increased Mobility Because the "switching cost" of moving is lower (no more sunken broker fees), tenants may feel freer to move when their lease ends rather than staying in an apartment they dislike just to avoid fees.

What This Means for Landlords

1. Increased Operating Expenses Landlords can no longer pass the cost of marketing and tenant screening onto the tenant as a separate line item. This is now an operational cost of doing business.

2. Potential Rent Adjustments Many analysts predict that landlords may increase monthly rents slightly to amortize the cost of the broker fee over the course of a lease. However, the market will dictate this cap; landlords cannot raise rents above what the market will bear.

3. A Shift to Direct Listing Landlords now have a strong financial incentive to cut out the middleman. We expect to see a surge in landlords using platforms like get.apartments to connect directly with qualified renters, bypassing the 1-month broker commission entirely.

Clarification: Can a Tenant Still Pay a Fee?

Yes, but only by choice.

If you are too busy to scroll through listings and you decide to hire a professional to manage your search, schedule your tours, and negotiate on your behalf, you will sign a contract agreeing to pay that agent. This is a payment for a specific service rendered to you, rather than a forced fee for a service rendered to the landlord.

Summary

The FARE Act brings NYC in line with the rest of the world. It incentivizes transparency and forces value. Landlords will look for more efficient ways to find tenants, and renters will no longer be blindsided by five-figure fees for apartments they found themselves online.

At get.apartments, we have always believed that the most efficient market is a transparent one. By matching renters directly with landlords, we help both parties save money—legislation or not.

Read Next

Jan 11, 2026

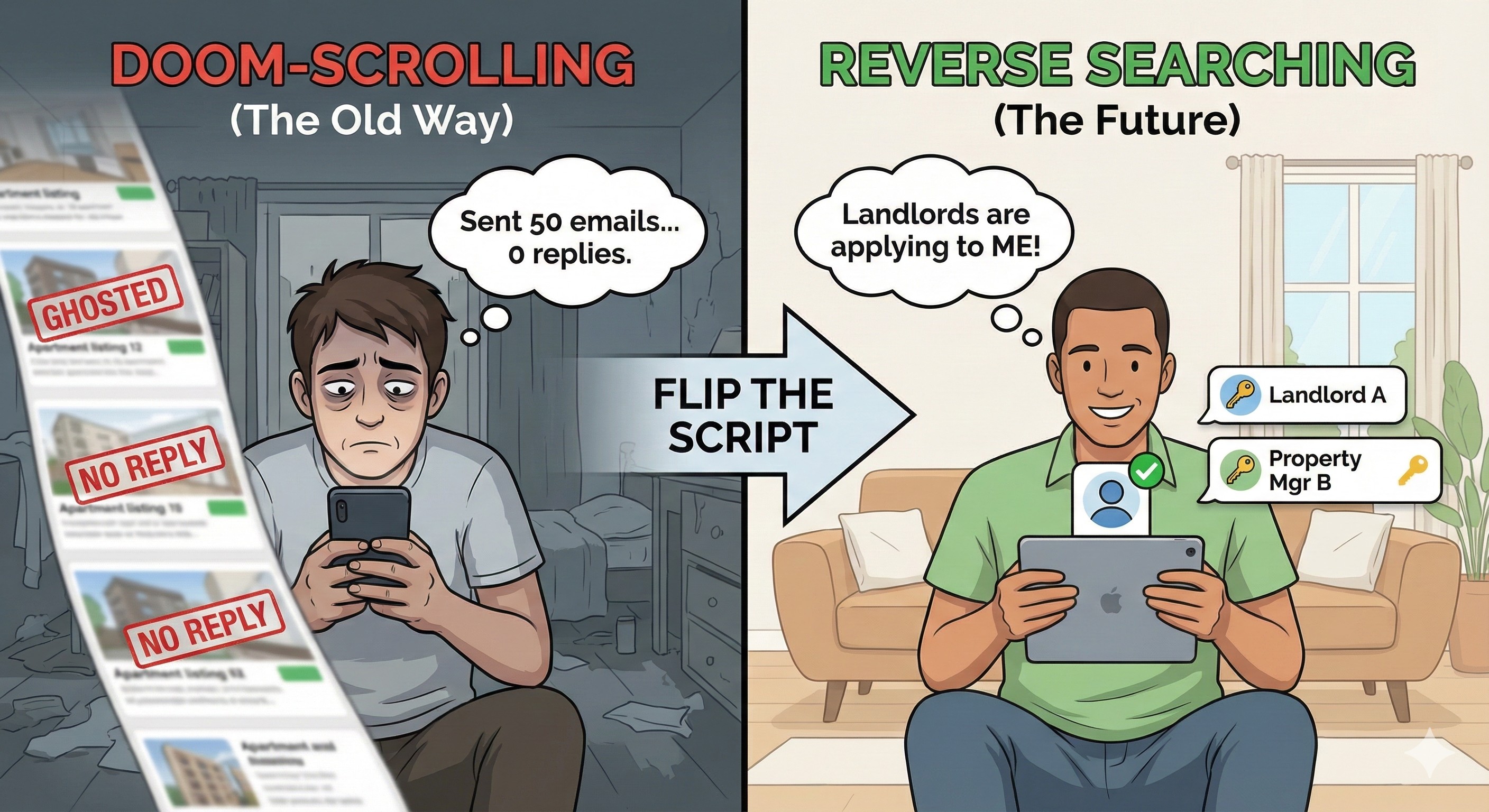

Stop Doom-Scrolling: Why "Reverse Searching" is the Future of Renting

Tired of refreshing rental apps and sending endless emails into the void? The traditional apartment hunt is broken. Discover how "reverse searching"—where landlords compete for you—is changing the game and saving renters time, stress, and money.

Jan 11, 2026

Tenant Rights 101: Heat, Hot Water, and Security Deposits in NYC

Renting in New York City comes with a specific set of legal protections. From the "Heat Season" calendar to the 14-day rule for security deposits, here is the essential guide to your rights as a tenant.

Jan 11, 2026

The Ultimate NYC Moving Checklist: From 8 Weeks Out to Moving Day

Moving in New York City isn't just about packing boxes; it's about navigating freight elevator schedules, Certificates of Insurance, and parking regulations. Our comprehensive timeline keeps you organized so your move is exciting, not exhausting.