The Hidden Cost of Vacancy: Why Waiting for the "Perfect" Tenant is Costing You Thousands

There is a common psychological trap in real estate investment: The "Face Rent" Fallacy.

As a landlord, you have a number in your head. Maybe you determined that your unit in Crown Heights is worth exactly $3,000 a month. When prospective tenants ask for $2,950, you say no. When a broker asks you to cover the fee to close the deal, you refuse on principle. You decide to wait for the tenant who agrees to your exact terms.

Three weeks go by. Then four. The apartment is still empty.

You might feel like you "held your ground," but mathematically, you have just lost a significant amount of money. In the rental game, time is the most expensive asset you own.

The Math: The $3,000 Mistake

Let’s look at a hypothetical scenario using a standard 1-bedroom apartment priced at $3,000 per month.

Scenario A: The Holdout You refuse to lower the rent or pay a fee. The unit sits vacant for exactly one month (30 days) while you wait for the perfect full-price applicant.

-

Vacancy Loss: $3,000

-

Total 12-Month Income: $33,000

Scenario B: The Strategic Drop You agree to lower the rent by $50 to close a deal immediately (day 1).

-

Monthly Rent: $2,950

-

Annual Loss from Drop: $50 x 12 months = $600

-

Total 12-Month Income: $35,400

The Result: By "losing" $50 a month, you actually made $2,400 more over the course of the year compared to letting the unit sit empty for just 30 days.

The Broker Fee Equation (OP)

With the new FARE Act and shifting market dynamics, many landlords are hesitant to pay the broker fee (OP). However, treating the broker fee as a marketing expense can save your bottom line.

Let's stick with our $3,000 unit.

If paying a one-month commission ($3,000) gets a tenant in immediately versus waiting two months for a direct renter:

-

Waiting 2 Months: $6,000 lost revenue.

-

Paying the Fee: $3,000 expense.

-

Savings: You are up $3,000 by paying the fee.

Furthermore, by paying the fee/concession rather than lowering the rent, you maintain the higher Face Rent ($3,000). This is crucial for building valuation if you plan to refinance or sell, as the property's value is based on the rent roll.

The Invisible Costs of Empty Units

Beyond the simple math of lost rent, vacancy carries hidden liabilities:

-

Utilities: You are paying for heat and electricity to keep the pipes from freezing in an empty apartment.

-

Insurance Risk: Many insurance policies have clauses about properties left vacant for more than 30 days, potentially raising your premiums or voiding coverage.

-

Security: An empty unit is a target for break-ins or squatters. A tailored, occupied unit is a safe unit.

How to Fill Vacancies Faster

The key to avoiding vacancy loss is exposure to qualified intent.

Traditional listing sites rely on passive waiting. You post an ad and hope the right person sees it.

get.apartments uses a Reverse Market approach. Instead of waiting for applications, you can browse a database of pre-qualified renters who have already verified their income and credit. You can see exactly who is looking for a unit like yours right now.

Don't let your ego dictate your pricing. Do the math. If you see a qualified renter on our platform who is $50 under your asking price, send them a message. Closing the deal today is almost always cheaper than waiting for tomorrow.

Read Next

Jan 11, 2026

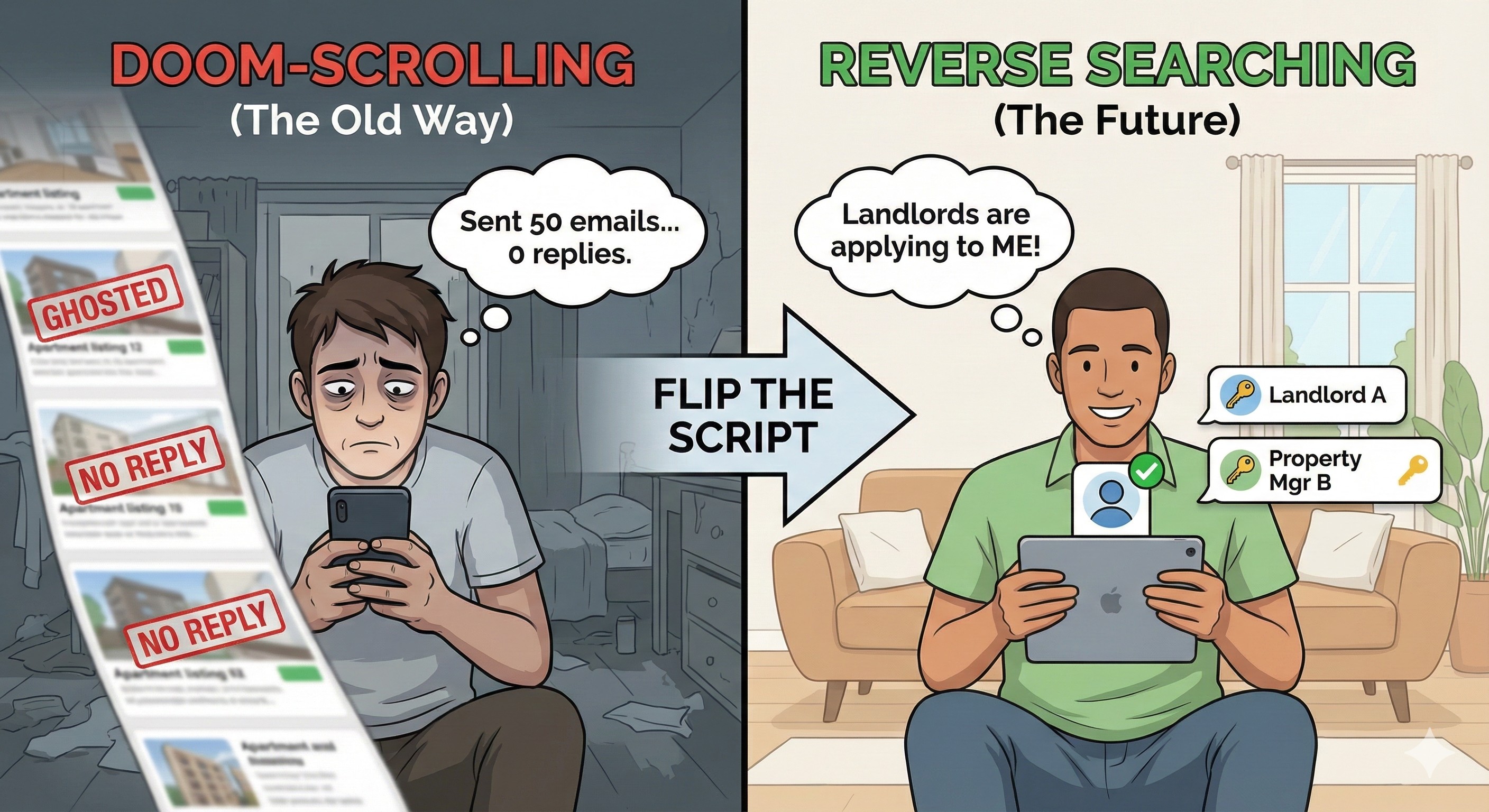

Stop Doom-Scrolling: Why "Reverse Searching" is the Future of Renting

Tired of refreshing rental apps and sending endless emails into the void? The traditional apartment hunt is broken. Discover how "reverse searching"—where landlords compete for you—is changing the game and saving renters time, stress, and money.

Jan 11, 2026

Tenant Rights 101: Heat, Hot Water, and Security Deposits in NYC

Renting in New York City comes with a specific set of legal protections. From the "Heat Season" calendar to the 14-day rule for security deposits, here is the essential guide to your rights as a tenant.

Jan 11, 2026

The Ultimate NYC Moving Checklist: From 8 Weeks Out to Moving Day

Moving in New York City isn't just about packing boxes; it's about navigating freight elevator schedules, Certificates of Insurance, and parking regulations. Our comprehensive timeline keeps you organized so your move is exciting, not exhausting.