The 40x Rent Rule in NYC: What It Is & How to Beat It

Moving to New York City is an adventure. Applying for an apartment in New York City, however, is often a math test. If you have started browsing listings, you have likely encountered the most famous (and feared) requirement in NYC real estate: The 40x Rule.

It is the standard financial benchmark used by almost every landlord and management company in the five boroughs. But what exactly is it? And more importantly, if you are a student, a freelancer, or just starting your career, how do you get an apartment if you don't meet it?

Don't panic. Here is everything you need to know about the 40x rule and the workarounds that actually work.

The Math: How the 40x Rule Works

The rule is simple: Your gross annual income must be at least 40 times the monthly rent.

Landlords use this formula to ensure you aren't "rent-burdened." Financial experts generally agree that you shouldn't spend more than 30% of your gross income on housing. The 40x rule is just a quick way to calculate that.

The Formula: Monthly Rent x 40 = Minimum Annual Income

Here is what that looks like in practice for common NYC price points:

-

$2,000/mo rent requires $80,000 annual income.

-

$2,500/mo rent requires $100,000 annual income.

-

$3,000/mo rent requires $120,000 annual income.

-

$4,000/mo rent requires $160,000 annual income.

Note for Freelancers: "Income" usually means your net income after business expenses as shown on your tax returns, not just your total revenue.

I Don't Make 40x the Rent. Now What?

If you crunched the numbers and fell short, you are not alone. Thousands of New Yorkers rent apartments every day without meeting the strict 40x requirement. Here are the five most common solutions.

1. Use a Personal Guarantor (The 80x Rule) A personal guarantor is someone (usually a parent or relative) who signs the lease with you. They agree to pay the rent if you default. Because they have their own housing expenses, landlords hold them to a higher standard: The 80x Rule.

Your guarantor usually needs to live in the Tri-State area (NY, NJ, CT) and show an income of 80 times your monthly rent. For a $2,500 apartment, your guarantor needs to make $200,000.

2. Use an Institutional Guarantor If you don't have a rich uncle in Connecticut, you can hire a company to be your rich uncle. Services like Insurent, TheGuarantors, or Rhino act as your guarantor for a fee.

You pay them a percentage of the annual rent (usually around 70-85% of one month's rent), and they issue an insurance policy to the landlord. If you stop paying, they cover it. This is a favorite solution for international students and freelancers with high liquid savings but inconsistent monthly income.

3. Combine Incomes with Roommates The 40x rule applies to the household, not necessarily the individual. If you are renting a $3,000 two-bedroom apartment with a friend, you don't both need to make $120,000. You need to make $120,000 combined.

(Warning: Some strict landlords require each roommate to qualify individually, but this is less common in the boroughs outside of Manhattan.)

4. Show Assets Instead of Income If you are retired, in between jobs, or sitting on a trust fund, you might have money in the bank but no pay stubs. Some landlords will accept "significant liquid assets" in lieu of income.

Typically, they want to see that you have enough cash in the bank to cover the entire lease term plus expenses, or roughly 60-80x the monthly rent in liquid accounts.

5. The "Reverse Market" Approach The hardest part of not meeting the 40x rule is the rejection. You spend hours applying to apartments on Streeteasy only to be told "No."

This is why we built get.apartments. Instead of chasing listings, you post a "Desire." You state upfront: "My budget is $2,400, I make 35x the rent, but I have a guarantor."

Landlords viewing your profile already know your financial situation before they reach out to you. If a landlord contacts you here, they are already willing to work with your numbers. It saves you time, application fees, and the headache of rejection.

A Note on "Paying Upfront"

In the past, you could offer to pay 6 months or a year of rent upfront to secure an apartment. This is now illegal in NYC. Under the Housing Stability and Tenant Protection Act of 2019, landlords cannot accept more than one month's rent as a security deposit and the first month's rent. Do not offer this—it flags you as someone who doesn't know the law!

Summary

The 40x rule is a barrier, but it isn't a wall. Whether you use a guarantor, get a roommate, or use a platform like ours to find flexible landlords, there is a way into your dream NYC apartment.

Read Next

Jan 11, 2026

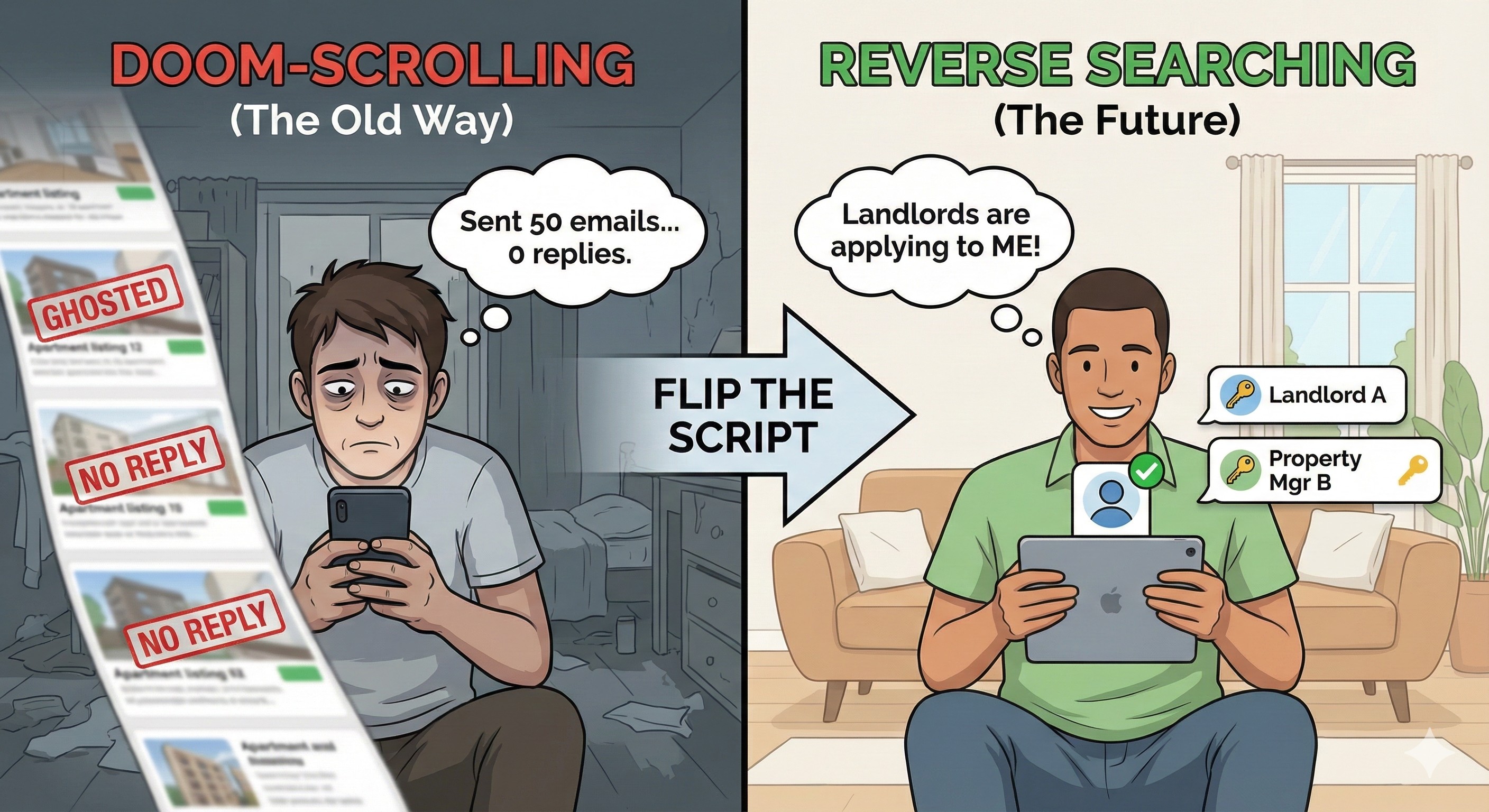

Stop Doom-Scrolling: Why "Reverse Searching" is the Future of Renting

Tired of refreshing rental apps and sending endless emails into the void? The traditional apartment hunt is broken. Discover how "reverse searching"—where landlords compete for you—is changing the game and saving renters time, stress, and money.

Jan 11, 2026

Tenant Rights 101: Heat, Hot Water, and Security Deposits in NYC

Renting in New York City comes with a specific set of legal protections. From the "Heat Season" calendar to the 14-day rule for security deposits, here is the essential guide to your rights as a tenant.

Jan 11, 2026

The Ultimate NYC Moving Checklist: From 8 Weeks Out to Moving Day

Moving in New York City isn't just about packing boxes; it's about navigating freight elevator schedules, Certificates of Insurance, and parking regulations. Our comprehensive timeline keeps you organized so your move is exciting, not exhausting.