No-Fee vs. Fee Apartments: The Real Cost Breakdown

In New York City real estate, three little words can change your entire financial year: "No Broker Fee."

For decades, the standard practice in NYC has been for the tenant to pay the broker's commission, even if the broker was hired by the landlord. This fee typically ranges from one month's rent to 15% of the annual rent.

On a $3,000 apartment, a 15% fee is $5,400. That is a check you write before you even move in, and you never see that money again.

But here is the common counter-argument: "No-Fee apartments are just more expensive. The landlord bakes the fee into the rent."

Is that true? And even if it is, which option actually saves you money? Let's stop guessing and look at the hard math.

The Scenario: Fee vs. No-Fee

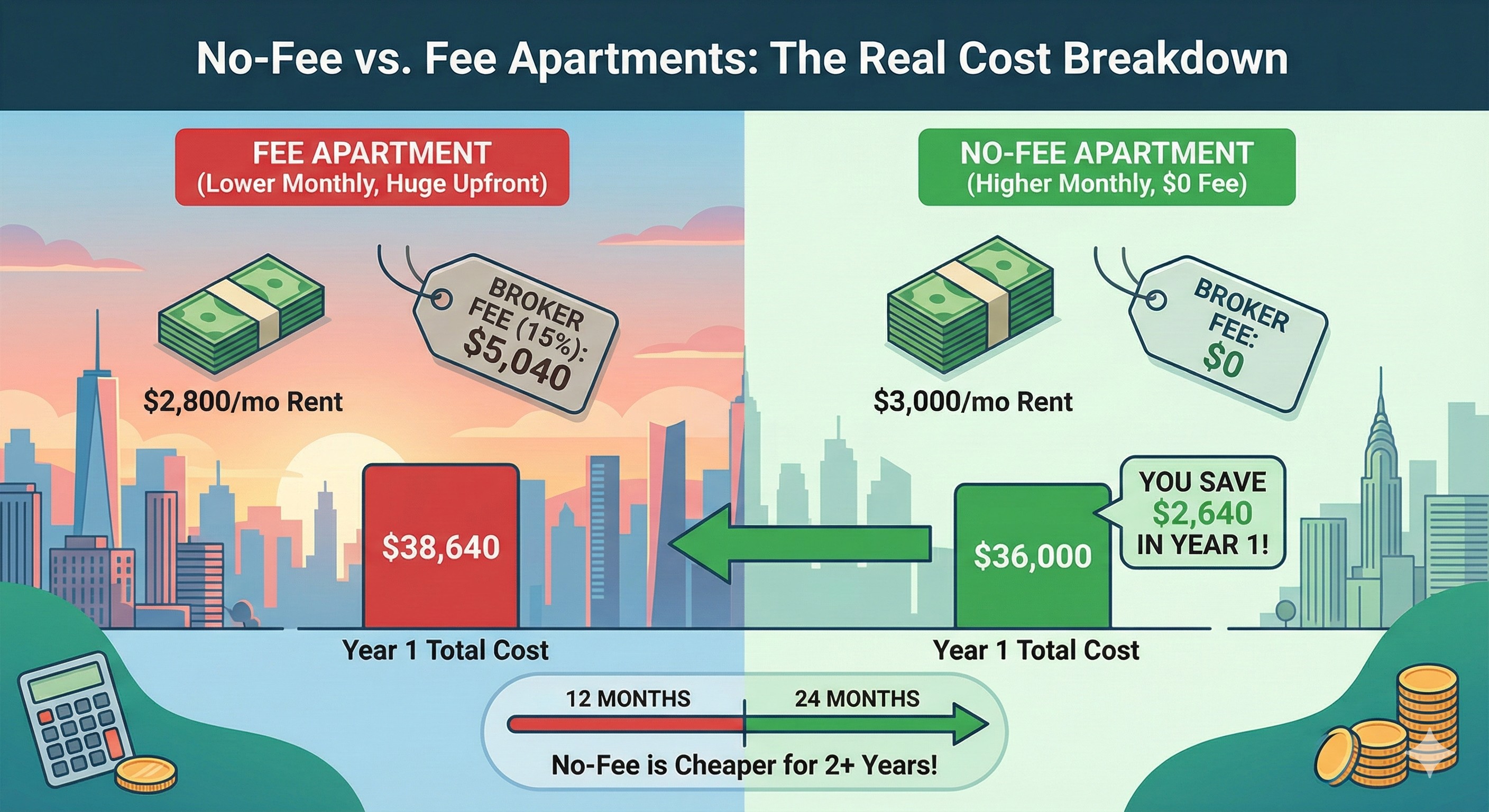

Let's compare two similar apartments in the same neighborhood.

-

Apartment A (Fee): Listed at $2,800/month. It requires a 15% broker fee.

-

Apartment B (No-Fee): Listed at $3,000/month. You pay $0 in broker fees.

At first glance, Apartment A looks cheaper. It saves you $200 every single month. But the upfront cost changes everything.

The 12-Month Breakdown

If you only plan to stay for one year (a standard lease), here is how the costs stack up.

Apartment A ($2,800 + Fee)

-

Annual Rent: $33,600 ($2,800 x 12)

-

Broker Fee (15%): $5,040

-

Total 1st Year Cost: $38,640

-

Effective Monthly Cost: $3,220

Apartment B ($3,000 No-Fee)

-

Annual Rent: $36,000 ($3,000 x 12)

-

Broker Fee: $0

-

Total 1st Year Cost: $36,000

-

Effective Monthly Cost: $3,000

The Verdict: By choosing the "more expensive" No-Fee apartment, you save $2,640 in the first year.

The 24-Month Breakdown (The "Break-Even" Myth)

The argument for paying a fee is usually longevity. "If I stay for two or three years, the lower rent eventually pays for the fee."

Let's test that.

Apartment A ($2,800 + Fee)

-

Year 1 Total: $38,640

-

Year 2 Rent: $33,600

-

Total 2-Year Cost: $72,240

Apartment B ($3,000 No-Fee)

-

Year 1 Total: $36,000

-

Year 2 Rent: $36,000

-

Total 2-Year Cost: $72,000

The Verdict: Even after two full years, you are still $240 poorer if you chose the apartment with the fee.

You would need to live in Apartment A for 26 months just to break even. In a city where the average renter moves every 1-2 years, paying a broker fee is almost always a losing bet.

The "Cash Flow" Factor

Beyond the total cost, there is the issue of liquidity.

To move into Apartment A, you need to hand over a massive amount of cash on day one:

-

First Month: $2,800

-

Security Deposit: $2,800

-

Broker Fee: $5,040

-

Move-In Cost: $10,640

To move into Apartment B (No-Fee), your move-in cost is:

-

First Month: $3,000

-

Security Deposit: $3,000

-

Broker Fee: $0

-

Move-In Cost: $6,000

The No-Fee option keeps $4,640 in your bank account on moving day. That is money you can use for movers, new furniture, or investing.

Summary

The math is clear: Unless you plan to stay in an apartment for 3+ years, a "No-Fee" unit is mathematically superior, even if the monthly rent is slightly higher. It offers lower move-in costs, lower effective monthly costs, and greater financial flexibility.

At get.apartments, we specialize in connecting renters directly with landlords and no-fee listings so you can keep that 15% where it belongs—in your pocket.

Read Next

Jan 11, 2026

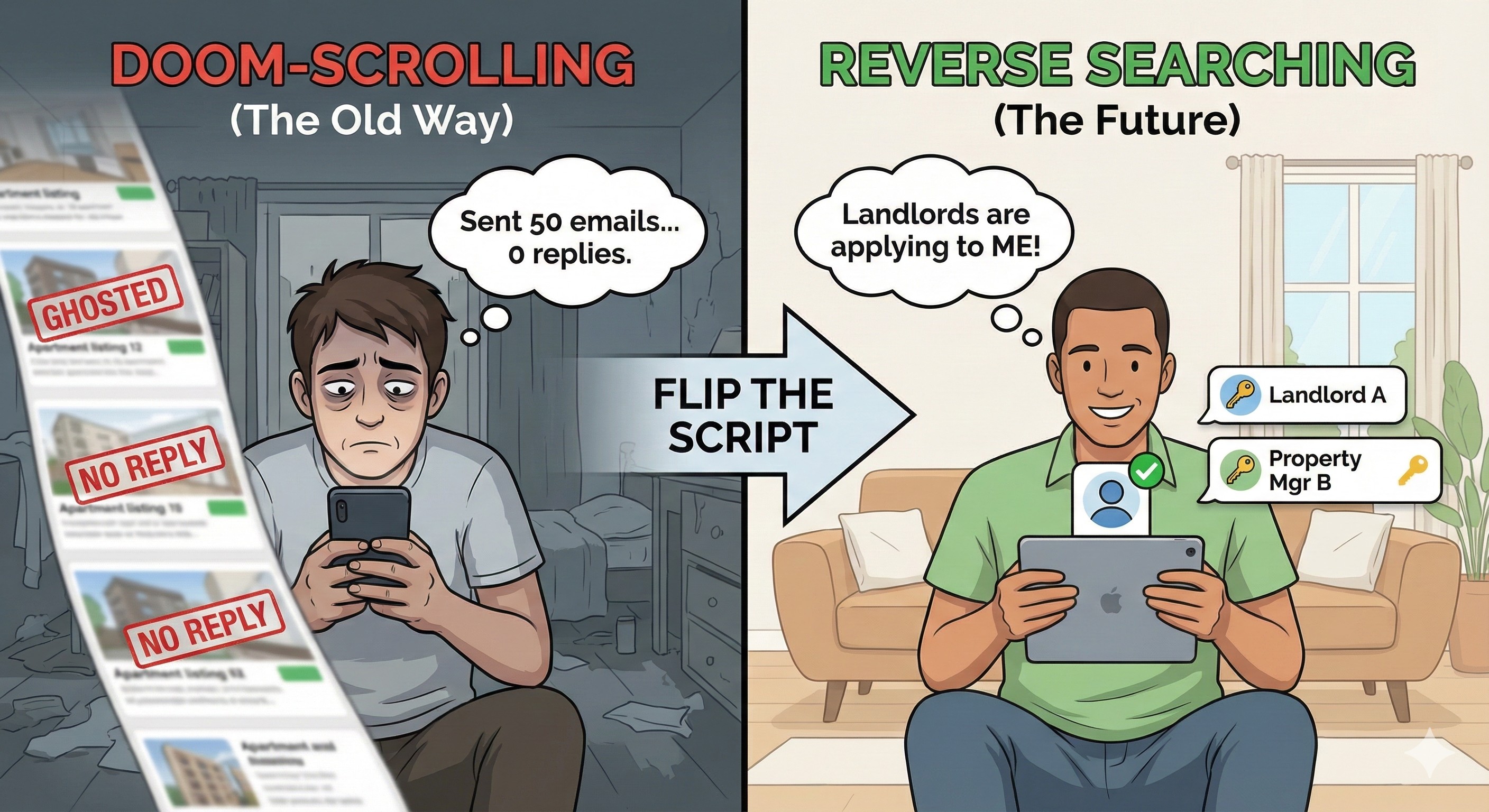

Stop Doom-Scrolling: Why "Reverse Searching" is the Future of Renting

Tired of refreshing rental apps and sending endless emails into the void? The traditional apartment hunt is broken. Discover how "reverse searching"—where landlords compete for you—is changing the game and saving renters time, stress, and money.

Jan 11, 2026

Tenant Rights 101: Heat, Hot Water, and Security Deposits in NYC

Renting in New York City comes with a specific set of legal protections. From the "Heat Season" calendar to the 14-day rule for security deposits, here is the essential guide to your rights as a tenant.

Jan 11, 2026

The Ultimate NYC Moving Checklist: From 8 Weeks Out to Moving Day

Moving in New York City isn't just about packing boxes; it's about navigating freight elevator schedules, Certificates of Insurance, and parking regulations. Our comprehensive timeline keeps you organized so your move is exciting, not exhausting.